Date: Jun 07 2019

Qualified Opportunity Zones (QOZs) offer taxable investors the potential for deferral of existing gains and tax-free growth. Though the basic provisions of the tax incentive are known, the rules remain unclear and regulatory risks persist. While the tax incentives may be beneficial, investment decisions should not be primarily driven by tax considerations.

Even though the existence of a tax incentive can make a good investment even better, we continue to believe that investment decisions should not be primarily driven by tax considerations. Investors interested in allocating to Qualified Opportunity Funds (QOFs) should exercise caution in selecting a reputable manager with expertise in managing speculative real estate investments and understand the risk profile of underlying investments. Hold periods for these strategies will be lengthy, and there remains potential for price distortions caused by the herding of investors into and out of QOZs. Investors interested in the social benefits of the incentive should also take care to understand plans to engage the community and avoid the pitfalls of gentrification or displacement that may occur.

Background

The 2017 Tax Cuts and Jobs Act created a tax incentive for QOF investors in order to promote investment in specified QOZs. These QOZs are generally located in low income communities with potential for revitalization, and many of the 8,500 census tracts identified were nominated by state governors for inclusion. Though this provision has sparked interest among investors, the IRS has still not issued final guidance on the law’s implementation, creating a lingering uncertainty that may limit investors’ flexibility, or even endanger eligibility for the incentive altogether.

The Tax Benefits

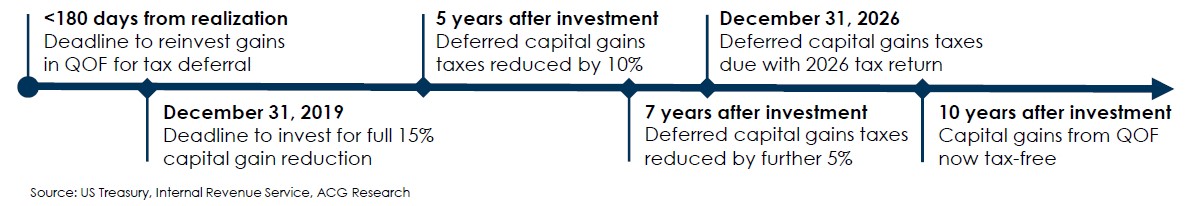

Investors in QOFs receive multiple tax benefits. Taxes due on realized capital gains reinvested in a QOF within 180 days of realization are deferred until the earlier of investment disposal or December 31, 2026. If the investment is held for at least five years, this deferred tax is reduced by 10% with a further 5% reduction if held for at least seven years. Due to the hard deadline of the 2026 tax year, only investments made on or before December 31, 2019 will receive the full benefit of this reduction. Finally, any QOF investment held for at least 10 years is fully exempt from capital gains taxation. In order for a QOF to qualify for this preferred tax treatment, the tangible assets of an investment must be “substantially improved”—defined as doubling the cost basis of the asset within 30 months of investment. This substantial improvement test will most likely be met through either redevelopment or ground-up development.

The Rules are Still Being Written

As of this writing, the IRS has not issued final guidance on the rules of the QOZ tax incentive program, despite the fact that QOFs have already begun to raise and deploy capital from investors. Among the major unsettled issues to be ruled upon, it is unclear if investors will be permitted to take cash out of QOF investments through the issuance of debt or a mortgage, whether the preferential tax treatment offered by the program would pass to a deceased investors’ heirs, and whether a QOF is permitted to buy and sell assets within the fund while preserving the capital gains tax exemption. The tax law also allows for the possibility of investing in operating businesses located within QOZs, but very little guidance has been issued on this subject, including the criteria for determining a business to be eligible for the incentive in the first place.

Click to view larger

Losses are Always Capital Gains Tax Free

Development-focused or heavy value-added real estate investments do not come without risks, especially ten years into a real estate expansion. Additionally, most QOZs are, by their nature, in less developed and potentially riskier geographic locations than alternative real estate projects with a similar development or redevelopment focused profile. Investors considering an allocation to a QOF should carefully consider the expertise and track record of the manager, as well-publicized tax incentives tend to encourage tourists and opportunists to enter the market in search of funding. We have already observed an increase in deal activity within QOZs that may result in pricing pressure that reduces investors’ room for error. It’s entirely possible, given the tight clustering of investment due to the effective December 31, 2019 deadline to maximize the law’s tax benefits, a similar rush for the exits may occur in 2029 as QOFs collectively seek to realize their investments.

The Social Costs/Benefits

Though the intent of the QOF tax incentive is to bring economic development and growth to historically disadvantaged areas, the social impacts of the program remain somewhat unclear. Some QOFs were drawn based on stale 2010 data, including parts of Downtown Seattle and Portland that have already seen explosive economic growth in the last decade. Experts also disagree on the potential impacts on the designated communities, with the promise of economic development and the restoration of blighted areas weighed against the potential for gentrification and displacement of local communities.

About ACG

Asset Consulting Group (ACG) is an investment consulting firm focused exclusively on providing comprehensive, customized and objective investment advice to a select group of clients.

This year, we celebrate our 30th anniversary in business - an exciting and meaningful milestone.

At ACG, our success and longevity are a result of the depth and stability of our team, our accuracy and innovation, our expert research, and the custom solutions we provide to our clients.

We advise to over 100 billion dollars in client assets. Our structure combines the resources of a larger firm with the flexibility of a smaller firm. Our clients include private investors, endowments, foundations, pension funds & insurance companies.

Our Managing Directors have worked together at ACG for an average of 18 years, providing both consistency and continuity in our approach and process.

Our senior investment professionals have over 250 years of collective industry experience in various sectors including investment management, securities trading, custody, real estate mortgage banking and the public accounting industries.